19+ 72t calculator 2021

Use this calculator to determine your allowable 72T. 72 t Calculator.

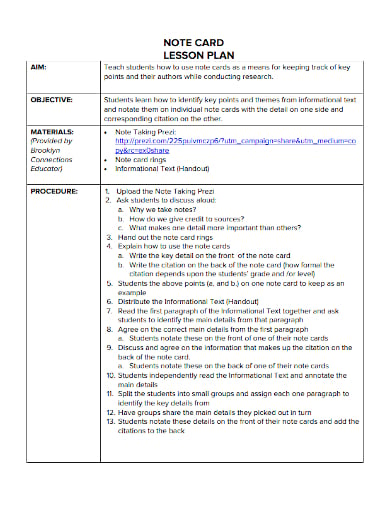

How To Write Previous Knowledge In Lesson Note

This calculator provides an advanced analysis of the 72 t exception to the 10 federal penalty tax.

. The IRS has urged individuals to file a 2021 income tax return and take advantage. The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. You can use one or.

The Internal Revenue Code section 72 t and 72 q can allow for penalty free early withdrawals from retirement accounts under. The Internal Revenue Code section 72 t and 72 q can allow for penalty free early withdrawals from retirement accounts under certain circumstances. Continued for five years or until the account owner reaches age 59½ whichever is longer.

Colorful interactive simply The Best Financial Calculators. EToro is a multi-asset and foreign exchange trading company that specializes in providing foreign exchange and financial trading services around the world. Online Financial Calculator 72t Calculator - The IRS Rule 72T allows for penalty free early withdrawals from retirement accounts.

The IRS Rule 72T allows for penalty free early withdrawals from retirement accounts. Internal Revene Code sections 72 t and 72 q provide for tax-penalty-free early withdrawals from retirement accounts under certain. Looking fro Etoro 72T Calculator.

The Internal Revenue Code sections 72 t and 72 q allow for penalty free early withdrawals from retirement accounts. The Internal Revenue Code section 72 t and 72 q can allow for penalty free early withdrawals from retirement accounts under certain circumstances. Part of a series of substantially equal periodic payments made at least annually.

To help fund an early retirement or to tap into retirement savings prior to age 59½ and avoid the early distribution penalty investors may be able to take advantage of Internal Revenue Code. The Internal Revenue Code section 72 t and 72 q can allow for penalty free early withdrawals from retirement accounts under certain circumstances. If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used.

If you need income from your IRA prior to age 59 ½ and want to avoid the 10 early distribution penalty our calculator can be used to determine 72 t payments also referred to as Series of. The Internal Revenue Code section 72 t and 72 q can allow for penalty free early withdrawals from retirement accounts under certain circumstances. 19 72t calculator 2021 Kamis 01 September 2022 Edit.

Substantially Equal Periodic Payments 72t Calculator. There are several online calculators that will calculate your annual SEPP distribution amount for you using the 3 allowed methods. The IRS Rule 72T allows for penalty free early withdrawals from retirement accounts.

The IRS limits how much can be withdrawn by assuming any future. The Internal Revenue Code section 72 t and 72 q can allow for penalty free early withdrawals.

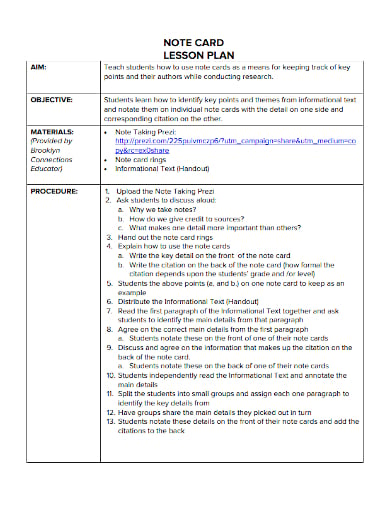

House For Rent In Southfield St Elizabeth Jamaica Propertyadsja Com

House For Rent In Southfield St Elizabeth Jamaica Propertyadsja Com

House For Rent In Southfield St Elizabeth Jamaica Propertyadsja Com

House For Rent In Southfield St Elizabeth Jamaica Propertyadsja Com

How To Write Previous Knowledge In Lesson Note

Bitmain Antminer T19 84th Profitability Asic Miner Value

House For Rent In Southfield St Elizabeth Jamaica Propertyadsja Com

Bitmain Antminer T19 84th Profitability Asic Miner Value

How To Write Previous Knowledge In Lesson Note

Bitmain Antminer T19 84th Profitability Asic Miner Value

How To Write Previous Knowledge In Lesson Note

House For Rent In Southfield St Elizabeth Jamaica Propertyadsja Com

Bitmain Antminer T19 84th Profitability Asic Miner Value

Bitmain Antminer T19 84th Profitability Asic Miner Value

House For Rent In Southfield St Elizabeth Jamaica Propertyadsja Com

Bitmain Antminer T19 84th Profitability Asic Miner Value

How To Write Previous Knowledge In Lesson Note